Life Insurance Plans: Compare & Buy Best Life Insurance Plan

Life Insurance, in straightforward terms, is an agreement which is marked between an individual and an insurance supplier, wherein the insurance supplier certifications to pay a specific total of cash (whole guaranteed) if there should be an occurrence of the protected person's death. So as to profit of this security, the protected pays a specific sum as premium towards keeping up the policy.

It is only a wellbeing net which gives monetary security/insurance against death toll. The main role of a life insurance policy is to secure the money related premiums of the protected's family.

While one may believe this is an ongoing idea, thinks about have demonstrated that it has been around for quite a long time, with various varieties of insurance going back to 1750 BC.

What is Life Insurance ?

Life Insurance is an assertion between an insurance company and a policyholder, under which the safety net provider certifications to pay a guaranteed a portion of the cash to the designated recipient in the heartbreaking occasion of the policyholder's end amid the term of the policy. In return, the policyholder consents to pay a predefined aggregate of cash in type of premiums either all the time or as a single amount. On the off chance that incorporated into the agreement, some different possibilities, for example, a basic ailment or a terminal ailment can likewise trigger the installment of advantage. On the off chance that characterized in the agreement, some different things, for example, memorial service costs may likewise be a piece of the advantages.

Aside from the death benefits, a Life Insurance plan additionally gives maturity benefits. These advantages are given as a payout if the guaranteed survives the whole term of the policy. Besides, life insurance plans also offer a few tax deductions under Section 80C of the Income Tax Act, 1961.

- Death Benefit/Sum Assured :This is the cash which the safety net provider guarantees to pay to the candidate/recipient of the policyholder after his/her destruction. This changes in view of various parameters.

- Term :An insurance policy gives security to a specific timeframe. This is known as the term, and it could shift in the view of the kind of policy picked.

- Premium :An individual is agreed to cover just on the off chance that he/she pays a specific total of cash towards the policy. This is termed the premium. One can view it as the underlying investment which offers returns later on.

Why is Life Insurance Important?

The normal life hope in India is around 68 years, however we as a whole know individuals who passed away before they achieved this age. The flightiness of life can make irreversible harm our friends and family. A decent life insurance plan can help limit the monetary weight related with the departure of a dear one.

Given the pressure related to our day by day life, we regularly run over instances of individuals meeting a less than the ideal end, frequently leaving whole families broke after their destruction. Here are three primary reasons why one must consider putting resources into a life insurance plan.

- Peace of Mind : Peace is something we as a whole pursue, with just a couple of individuals prevailing in consistently discovering it. Acquiring an insurance plan can give a specific measure of peace, realizing that the welfare of your friends and family is dealt with if there should be an occurrence of any lamentable occasion. This empowers one to proceed with life, giving a chance to live minus all potential limitations without agonizing over what's in store.

- Money related security :An insurance plan deals with any monetary prerequisites the chosen one/recipient could have. One can redo a policy to meet individual desires. Furthermore, various us take advances to meet certain costs. This credit sum should be paid back, regardless of whether the borrower passes away. The weight of reimbursement falls on the family individuals in such cases. A life insurance plan can give adequate funds to reimburse any sum, guaranteeing that there are no extra liabilities to deal with.

- Extra income :Certain life insurance plans are intended to offer an extra wellspring of wage to the safeguarded amid his/her lifetime. These keep pace with expansion, giving conventional profits for the underlying investment. One can plan for the future by putting resources into a life insurance plan today.

Is it Important to Compare Life Insurance Plans Online?

Indeed, it is very important to compare the diverse life insurance plans offered before one chooses to buy them online. The comparison turns out to be much more essential when everything is being done online, for one won't have the assistance of specialists.

Customarily, insurance specialists would clarify a plan before the buy was finished. The virtual world, be that as it may, might not generally accompany help.

With several plans accessible it is basic that one inquiry and compares the distinctive highlights of each plan, guaranteeing that the chose plan suits the individual necessities of the person. There have been cases of individuals obtaining a policy without comparing them which have brought about issues amid the cases procedure.

All guarantors have a nearness online, with it simple to discover insights about their items. Not exclusively does this assistance spare time and exertion (when compared to disconnected comparison), it can likewise enable one to improve bargain on the top-notch sum.

Surveys of items and administrations by individuals who have put resources into them can be a special reward, offering a knowledge into what one could anticipate.

While one can simply ahead and buy a policy without comparing it, a more quick-witted choice is to check every other option, empowering one to get the best item in the market.

*1 Cr. Cover @

Rs.18/- per day

| Level of Protection: |

from Rs. 2500000 to Rs. 50000000 |

| Grace Period: |

up to 30 days |

| Hotline Assistance: |

24-Hour |

| Policy Modification: |

Online |

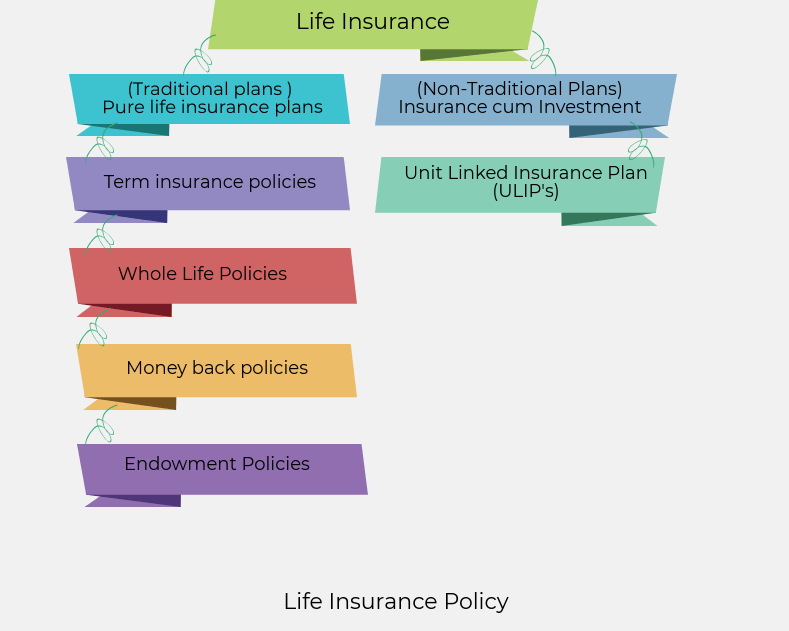

Types of Life Insurance :

Insurance in India is checked by the Insurance Regulatory and Development Authority of India (IRDAI). As of March 2016, the nation had 54 safety net providers, with 24 of these offering life insurance items. These safety net providers offer a differing scope of items, which can be classified into six wide composes, to be specific:

These are plans which give life cover to a settled timeframe. They can be either long haul or here and now plans, with the term extending from at least 5 years to a greatest of 60 years (or more) in specific cases. The safeguarded individual is ensured amid this term, with the insurance company paying his/her chosen one the sum assured on his/her death amid the policy term. No assurance is given if the safeguarded bites the dust after the term.

These can be considered as the most straightforward insurance plans accessible. While they are reasonable, they won't be a perfect choice, for there is no assurance after the said timeframe. These plans don't give a maturity benefit in all cases. One ought to think about these plans on the off chance that he/she anticipates their death inside a particular period (however it is near difficult to foresee the precision). This could be seen as 'transitory insurance' and is likewise alluded to as unadulterated life plans by specific back up plans.

Whole Life Policies :

A whole life policy, as the name suggests, offers security for the whole lifetime of a person. Certain safety net providers can have an upper age restrain for the maturity of the policy. These can be as insurance in addition to investment plans, wherein a death benefit is given to the chosen one on the downfall of the policyholder. In the event that there is a maturity benefit related to the plan, a maturity sum will be paid when the policyholder achieves the upper age restraint related to the plan.

While one should seriously mull over an entire life plan to be like a term plan, there are a couple of inconspicuous contrasts. The premium for an entire life plan is ordinarily higher, yet these plans additionally offer a maturity benefit, which isn't assured in the event of a term plan.

Endowment Policies :

An endowment plan fills a double need, offering life cover, as well as serving as a reserve funds instrument to take into account any future needs. Under these plans, the policyholder is refreshed assured of a sum, even on the maturity of the policy.

People who are hoping to ensure themselves monetarily amid the future can decide on such plans. These are perfect for individuals who may experience costs after a predetermined timeframe. These plans draw in a higher premium when compared to customary term plans. The premium is part into two noteworthy bits, with one of it going towards the essential sum assured and the other bit used as an investment instrument to offer profits for maturity.

While it is conceivable to have unit connected endowment arrangements, most safety net providers in India offer non-connected endowment plans.

Unit Linked Insurance Policies (ULIPs):

People searching for assurance in addition to returns can consider unit-connected insurance plans. These arrangements are 'connected' to advertise items like mutual funds, securities, stocks, and so forth. There is a sure measure of hazard-related with ULIPs, with this hazard falling on the policyholder.

Most safety net providers contribute a specific bit of the premium into advertising units, keeping the rest of the segment aside for the base sum assured. It is essential to watch out for the execution of the funds, for the profits could be irrelevant if there is a market crash. Thusly, the decision of an insurance company is basic. ULIPs can be a keen alternative for the wise financial specialist who wishes to put resources into a life insurance policy. Insurance organizations have committed store administrators who supervise the investment.

Retirement /Pension Plans :

Retiring from work can regularly be hard, given the way that cash may turn into an imperative. Retirement plans, otherwise called annuity/benefits plans can be utilized by people looking to monetarily anchor their resigned life. These are for the most part single premium strategies, wherein a singular amount sum is paid to the safety net provider.

One can pick the recurrence of payouts they wish to get, with the backup plan paying them a sum after they resign. This sum is paid all through their lifetime, ensuring budgetary security notwithstanding when one doesn't work. Certain annuity plans are unit connected, offering market-based comes back to policyholders.

Child Insurance Plan :

Gives financial coverage to your child's future needs and enables you to plan his/her future better and settle way. It is fundamentally a mix of insurance cover and investment that protected different phases of your child. Life cover is something that you will get as a singular amount sum toward the finish of the policy. Aside from this fundamental cover, the plan additionally helps you in offering adaptable payouts at vital phases of your child's life. Clearly you would prefer not to consider your death or any terrible episode however has you at any point felt that what your child would do after your death, how he/she will figure out how to anchor future. Essentially, a child insurance plan ensures that child's future money related requirements are dealt with even in your nonattendance.

In any case, you should know that typical investment funds would not have the capacity to manage the developing training costs. For the splendid eventual fate of your child, you should consider giving everything best to him and in such situation training expenses ought to be a requirement. Child insurance plans enable you to contribute in light of your child's instruction needs, your current money related status, and other financial objectives. Commonly, child insurance plans offer a life cover of around 10 times the yearly premium. Moreover, you will likewise get the withdrawal office as required. Alongside this, you can likewise profit tax reductions for the premium paid.

Money Back Plans:

Cash back strategies are a subset of endowment plans which give a survival benefit to the policyholder. These consider different possibilities. While a death benefit is payable on the downfall of the policyholder, the survival benefit will be paid in the event that he/she gets by for a specific timeframe.

Back up plans pay a specific level of the sum assured at standard interims, with this plan offering an extra wellspring of pay to policyholders. These plans are perfect for people who need a general wellspring of pay yet are not quick to go out on a limb related to showcasing instruments. The survival benefit is paid until the maturity of the policy. These plans are known for the liquidity they offer, making them a mainstream choice in the nation.

Investment plans :

This plan causes you in upgrading your riches, investment funds and get an insurance coverage also. With the thought process of enhancing lifestyle, better and lavish living yearnings and the developing concern influences individuals to consider contributing a sum to anchor what's to come.

With a similar thought process, investment plan is there to anchor all your monetary objectives with the present contributing assets. The reality of the matter is that contributing your cash takes a lot of time, instruments and assets. Without a doubt people are extraordinary thus their necessities are, so a solitary investment plan would not run well with everybody's prerequisites. These days, insurance companies are putting forth an extensive variety of viable investment plans

Every single Indian native, salaried, non-salaried, independently employed, some other experts and state/local government representatives over the age of 18 years can put resources into any type of investment plan gave by a few money-related foundations and insurance companies.

Tips for choosing an life Insurance

Confused about your cover options? Here few life insurance tips to help you make the right choice. Life insurance is an important part of financial planning. However, with all the complexities of different policies, understanding all of the ins-and-outs can be difficult.Here are few tips to help you make the right choice when looking for cover.

Buying a life insurance plan is a genuine work and care ought to be taken that simply in the wake of exploring legitimately you buy an appropriate item for yourself, for buying a wrong item may hurt you over the long haul. In this manner, it is critical to think about the different kinds of life insurance items that you can buy for yourself.

There are fundamentally four sorts of life insurance items that you may buy for yourself, i.e. term plans, unit-connected insurance plans, endowment plans and cash back plans. Life insurance plans expect to satisfy four noteworthy needs which are security, reserve funds, investment, and benefits.

Term plan is the most perfect type of insurance and gives just assurance to its clients. The premium paid by you is used to give you cover and thus term insurance premiums are greatly shabby in nature.

Unit Linked Insurance Plans (ULIP) are insurance-cum-investment item i.e. it gives both insurance and furthermore enables you to put your cash in various market devices. The controllers have put a top on the charges for ULIPs and consequently keeping in mind the end goal to choose a plan, you should compare the profits alongside different benchmarks accessible online. The cost structure of a ULIP is more effective as compared to a conventional plan, where the profits are probably going to be lower as compared to mutual funds.

Endowment plans can be known as a packaged insurance plans which gives you cover as well as causes you in augmenting your development and in this manner you should spare cash. The profits, be that as it may, are low and ranges from 4% to 6% for each annum.

Cashback plans are especially like endowment plans aside from that you begin getting a standard stream of pay amid the time your policy is still in drive and henceforth the profits are low going between 2% to 4% for every annum.

Picking the correct insurance plan is critical. On the off chance that you are unmarried and don't have any individual who is reliant on you, you may not require a life insurance since it means to give assurance to your friends and family in the event that something transpires. On the off chance that you have a family where the general population is reliant on you then it is prescribed that you buy a term insurance plan since it offers a higher sum assured with you paying low premiums. Two parameters on which you should buy a term insurance plan are claimed settlement ratio and the cost.

It is fitting to pick a plan with the best claim settlement ratio which ought to be over 90% and has the most minimal premium. The issue with other conventional plans is that the profits are low as well as surrendering it halfway will cost you a considerable measure. Henceforth, term insurance plans are probably going to be the best item you can benefit.

It's a given that you additionally get the chance to profit tax reductions under Section 80C of the Income Tax Act, 1961 on buying a life insurance plan.

Age Helps In Reducing Premium Rates :

You are here on this page implies you need to buy another life insurance plan? Pause, before you make any responsibility with respect to the same, it is basic to comprehend the exceptional idea of the coveted life insurance plan. Indeed, there are diverse decisions accessible in the market that go under the life insurance plan, for example, a term plan. A Term Plan works temporarily, the entire plan that develops money esteem or the all-inclusive approaches and significantly more. In all life insurance plans, the yearly premiums are affected by various factors, for example, well-being, sexual orientation, leisure activities, stature, weight, occupation and significantly more. You should know that the exceptional rate fluctuates from plan to plan and company to company. On the off chance that you are contemplating an entire life policy, at that point, the rate of profit for the money esteem can likewise influence the superior rates.

Whenever reached, specialists of insurance enterprises said that the age assumes an imperative part of the time spent setting premiums in the term and entire life insurance plans.

The Age Aspects :

The top-notch rates of life insurance arrangements rely on the age of the individual at the season of procurement and duration of the policy. The exceptional rates will increment by 8 to 10 percent consistently in light of the developing age. A specialist of the insurance business said that the excellent sum would increment by 5 to 8 percent in the 40s and if the policyholder is more than 50 age then his exceptional will increment by 9 to 12 percent consistently.

It is prudent to buy a life insurance plan at an early age as it helps in diminishing premium rates and gets unfaltering quality the same. Notwithstanding, in the entire life insurance, the top-notch rates do ascend with the age.

The rates of premium are determined by the guarantor every year, contingent upon the actuarial tables of the clerk. Also, they increment at each back to back age in light of the fact that every year there is an unrivaled deplete on the money esteem, owing to the expanded mortality charges

How to Choosing Online Life Insurance ?

In few ticks of a mouse, you get each one of the purposes of intrigue like policy technique, policy cites, and premiums. It is outstandingly fundamental and bothers allowed to purchase on the web. Searching for life insurance can be a troublesome system. There are an enormous number of different organizations accessible and numerous various plans that you'll need to investigate. It can be overwhelming and difficult to find the best policy, in any case, it doesn't should be. The Internet has impacted shopping basic and favorable for essentially anything you to can imagine. Today, people are despite gaining cars and homes online – so for what reason not purchase life insurance through the World Wide Web by looking at online life insurance cites? Reliably, most purchasers have been educated about and sold life insurance up close and personal. Regardless, in view of revived articulation advancement, there are various purposes important to searching for and looking at coverage decisions clearly from the comfort of your own home PC. The system for getting life insurance cites online has empowered buyers to analyze an extensive variety of sorts of life insurance plans from various bearers quickly and profitably. By empowering site visitors to interface with various policy decisions, clients are moreover prepared to gather plans that best fit the prerequisites of their own specific condition and spending plan. In like manner, overview and looking at cites for life insurance on the web can extremely save policyholders money. This is in light of the fact that the safety net providers' costs for overhead and literature are cut fundamentally by presenting on the web cites. Generally speaking, insurance organizations may even offer policyholders additional exceptional discounts for going "paperless" and paying their premiums online instead of sending in a paper check.

- Amount of Insurance :After assessing the sum for life insurance plan, you should move towards online insurance companies. There are numerous online insurance companies and it's extremely difficult to pick the coveted insurance plan out of them. Consequently, it is better for you to pick us. We will help you in comparing insurance plans of various companies at a similar place or on a solitary page.

- Give Accurate Information:It is critical to give the precise data in the chose insurance web aggregator proposition shape. In the wake of getting your data, we will give free quotes to the same. It will help you in completing a comparison for getting the best life insurance plan that can address your issues effortlessly.

- Select the Insurance Company :Once you get free quotes from various companies then you have numerous options. You would have the capacity to choose the coveted life insurance policy by comparing the quotes. From this, you will effortlessly choose the backup plan that can meet your prerequisites in term of spending plan and coverage too.

- Buy Online :After choosing the safety net provider, you can straightforwardly buy the life insurance plan from a similar page. For it, you need to finish a few conventions rely upon the company standards. It might be conceivable that you have to clear any medicinal test. You can get the important reports at home, you may need to sign it and give the required records that a company asks or as per the company's tenets.

- Your insurance plan resembles others authoritative reports that you have. It is smarter to guard it. You should ensure that your beneficiary thinks about it if there should arise an occurrence of any startling circumstance.

- The web has turned into a one plays to satisfy different sorts of requests. It is extremely an exceptionally basic process and does not cost any sum. Seeking online is truly outstanding and financially savvy approach to buy life insurance. It would be better in the event that you buy a life insurance plan at a youthful age as it can spare a major measure of your investment funds.